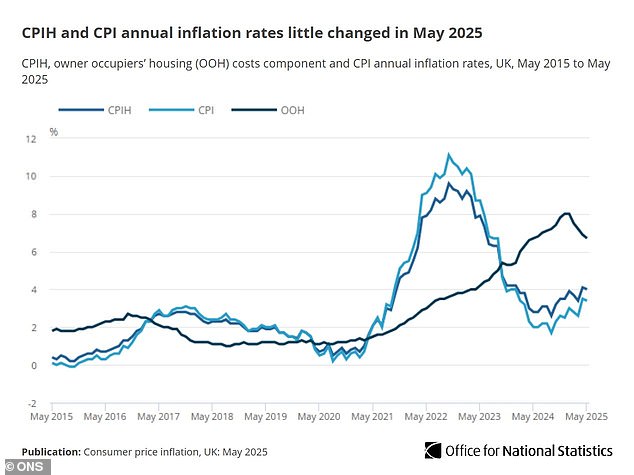

UK inflation held at 3.4 per cent last month, official data confirmed today following ‘awful April’ bill rises – in another blow for Chancellor Rachel Reeves.

The rate of Consumer Prices Index (CPI) inflation was 3.4 per cent in May, slightly down from the figure of 3.5 per cent for April that was issued last month.

Since releasing the previous figures for April, the Office for National Statistics (ONS) said an error in vehicle tax data collected meant the CPI rate for that month should have been 3.4 per cent – but it would not revise the official figure.

A consensus of analysts had expected CPI to fall to 3.3 per cent for May, ahead of the latest data being released today.

Ms Reeves said there was ‘more to do’ to bring down inflation and help with the cost of living, adding that the Government’s ‘number one mission is to put more money in the pockets of working people’.

She said: ‘We took the necessary choices to stabilise the public finances and get inflation under control after the double digit increases we saw under the previous government, but we know there’s more to do.

Chancellor Rachel Reeves is pictured on Monday during a visit to Gateshead, Tyne and Wear

‘Last week we extended the £3 bus fare cap, funded free school meals for over half a million more children and are delivering our plans for free breakfast clubs for every child in the country.

‘This Government is investing in Britain’s renewal to make working people better off.’

The figures mean prices were still rising in May at a similar rate to April when a raft of bills increased for households up and down the country.

The energy price cap, set by regulator Ofgem, rose by 6.4 per cent in April, resulting in bills for a typical household rising by £9.25 a month.

Steep increases to water charges, and rises for council tax, mobile and broadband tariffs, and TV licences were among those to take effect.

Meanwhile, oil prices have been rising in recent days since Israel launched an attack on Iran’s nuclear programme, raising concerns that the supply of crude from the Middle East could be disrupted.

Rising oil prices could threaten to push up inflation in the UK. Energy costs coming down has been one of the biggest contributors to overall inflation falling from the peaks hit during the cost-of-living crisis.

More to follow